COVID-19 Business Update – New Federal Stimulus & County in Red Tier

Earlier this week, the House voted to pass the American Rescue Plan (ARP) – the $1.9 trillion stimulus relief bill proposed by President Biden. The president signed the bill into action today.

This comprehensive bill provides funds in areas where little or no funds were available in prior stimulus relief bills, additional funds where prior funding was insufficient, and continued funding to ongoing relief program efforts.

Notably, relief will be extended specifically to restaurants, bars, and nonprofit organizations, as well as small businesses in Black, Latino, rural, and other communities that have suffered the worst economic impact of the pandemic.

The bill also provides the necessary funding to get Americans vaccinated, further speeding the progress toward reopening and setting the stage for economic recovery.

Small business owners will want to pay particular attention to a few items in the bill:

Paycheck Protection Program

The ARP includes $7.25 billion in fresh dollars for the Paycheck Protection Program (PPP) and will allow more nonprofits to apply, including groups that engage in advocacy and some limited lobbying. It will also render larger nonprofits eligible.

Business Support

Various provisions of the bill offer support to different industries. The Small Business Administration (SBA) is set to receive $28.6 billion for a new grant program for dining and drinking establishments that have suffered loss of revenue due to the pandemic. Grants will range up to $10 million per entity, and $5 million per individual location, with a maximum of 20 locations.

$5 billion is earmarked to be targeted to businesses with less than $500,000 in revenue in 2019. Another $1.25 billion is included for the SBA’s Shuttered Venue Operators Grant program.

$15 billion will fund the Economic Injury Disaster Loan (EIDL) Advance Grants Program, making available grants of up to $10,000 per business to small businesses in hard-hit, low-income communities.

A Community Navigator pilot program – an initiative designed to help small businesses in underserved and underbanked communities gain access to available COVID-19 relief resources – will receive $175 million.

The SBA will also receive $1.325 billion in administrative funding, equipping the agency with the resources and manpower necessary to implement its programs.

Applying for Support

At this time, it is not entirely clear when these resources will be available for applicants, so business owners are encouraged to remain vigilant in checking the SBA website, as well as other resource pages, such as the City of San Leandro’s COVID-19 Business Resources Page.

Entrepreneurs looking to maximize their relief will want to check SBA cross-program eligibility to see how much help they can receive from the federal government (as well as state and local organizations).

Additional Benefits Included in the Bill

- The plan extends a $300 per week jobless aid supplement and programs making millions more jobless people eligible for unemployment insurance benefits until September 6. The bill also makes the first $10,200 in individual jobless benefits tax-free.

- The bill will disburse $1,400 direct payments to most Americans and their dependents. The check amounts will be reduced, starting with individuals earning $75,000 or more ($150,000 for married couples filing jointly), and capping at individuals earning $80,000 or more ($160,000 for married couples filing jointly). Eligibility is determined from the most recently filed tax return.

- The Child Tax Credit is expanded for one year. The credit is increased to $3,600 for children under 6 and to $3,000 for children between 6 and 17.

- $20 billion is invested in COVID-19 vaccine manufacturing and distribution, in addition to $50 billion for testing and contact tracing.

- Rental and utility assistance receives $25 billion in additional funds, while mortgage aid will get $10 billion.

- $350 billion is earmarked for relief to state, local, and tribal governments.

- K-12 schools will receive $120 billion to aid with distance learning and re-opening costs.

- The Supplemental Nutrition Assistance Program program is increased by 15% through September.

- The plan also includes an expansion of subsidies and provisions to help Americans afford health insurance.

- The bill expands an employee retention tax credit designed to allow businesses to retain workers on payroll.

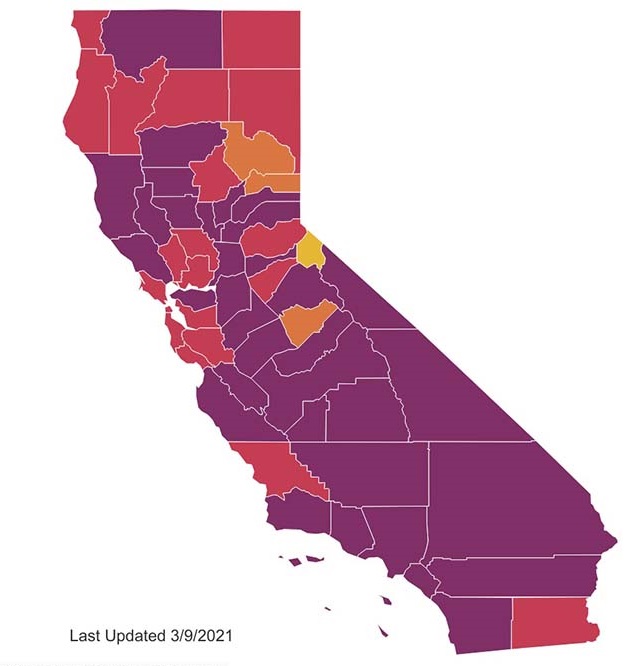

Alameda County In Red Tier

Effective March 10, 2021, the Alameda County Public Health Officer has declared that due to a significant decline in new case numbers and hospitalizations, the County is now operating in the Red (Substantial) Tier of the State’s Blueprint for a Safer Economy. This tier provides further allowances for reopening, as indicated below. The wearing of face masks, regular handwashing, and social distancing is still essential.

- Restaurants may open indoors at 25% maximum capacity or 100 people, whichever is fewer

- Retail may open indoors at 50% maximum capacity, and food courts are permitted per indoor dining restrictions

- Grocery stores may open at full capacity, while following retail industry guidance

- Movie theaters may open indoors at 25% maximum capacity or 100 people, whichever is fewer

- Museums, zoos, and aquariums may open indoors at 25% maximum capacity

- Gyms, fitness centers, and studios (including at hotels) may open indoors at 10% maximum capacity (climbing walls are permitted)

Leave a Reply