Restaurant Revitalization Fund is Accepting Applications!

On Monday, May 3, 2021 the Restaurant Revitalization Fund (RRF) opened for applications. Businesses are encouraged to apply right away! Learn more below or attend one of the upcoming info sessions (in multiple languages).

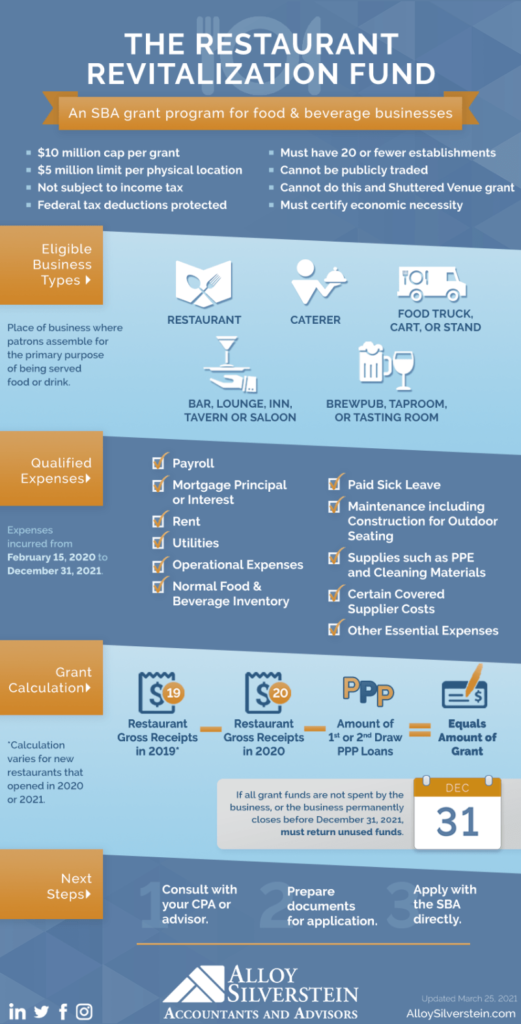

A program under the American Rescue Plan Act (ARPA), the RRF provides $28.6 billion in grant funding to restaurants and other dining and drinking businesses impacted by the pandemic. RRF grants will range from $1,000 up to $10 million per entity, and $5 million per individual location, with a maximum of 20 locations.

Eligible businesses are those that are not permanently closed and include businesses where the public or patrons assemble for the primary purpose of being served food or drink including:

- Restaurants

- Food stands, food trucks, food carts

- Caterers

- Bars, saloons, lounges, taverns

- Licensed facilities or premises of a beverage alcohol producer where the public may taste, sample, or purchase products

- Other similar places of business in which the public or patrons assemble for the primary purpose of being served food or drink

- Snack and nonalcoholic beverage bars

- Bakeries (specific requirements apply)

- Brewpubs, tasting rooms, taprooms (specific requirements apply)

- Breweries and/or microbreweries (specific requirements apply)

- Wineries and distilleries (specific requirements apply)

- Inns(specific requirements apply)

Please visit https://www.sba.gov/document/support-restaurant-revitalization-funding-program-guide to determine whether your business is eligible, and to apply, and watch the video below to learn how to apply.

You can also attend one of the many upcoming info sessions:

- En Español – Jueves, Mayo 6 – 3 – 4pm – Registrese www.sba.gov/restaurantes, 844-279-8898

- In English – Wednesday, May 13 – 10:30am – Register

- Applications in Chinese, Vietnamese, and other languages here.

- Check the NorCal SBDC calendar, as more trainings are being scheduled.

Don’t delay! There are countless businesses eligible to apply for this grant and the application period will only remain open for as long as funds remain. For the first 21 days, the program will prioritize applications where the applicant has self-certified that it meets the eligibility requirements for a small business owned by women, veterans, or socially and economically disadvantaged individuals.

How to Apply for the RRF:

California Businesses to Receive PPP Tax Break

Governor Gavin Newsom has signed a bill that will give small businesses hit hardest by this pandemic a $6.2 billion tax cut over the next six years – a critical lifeline that will help get our small businesses back on their feet and an important component of California’s economic recovery strategy.

Under the legislation, AB 80 by Assemblymember Autumn Burke (D-Inglewood), the forgiven PPP loans that businesses received from the federal government during the pandemic will not be counted as taxable income, and these businesses can also deduct the costs of expenses that those loans paid for. This is additional state tax relief for the small businesses that have been struggling most, and may very well make a difference in their choosing to reopen, stay open, or shut down as they look to the future.

Leave a Reply