San Leandro Launches Interactive Opportunity Zone Dashboard

The City of San Leandro has launched a new interactive Opportunity Zone Dashboard highlighting the city’s Opportunity Zone. The dashboard allows entrepreneurs, developers, and investors to learn about San Leandro’s Opportunity Zone, including specific locations and community assets.

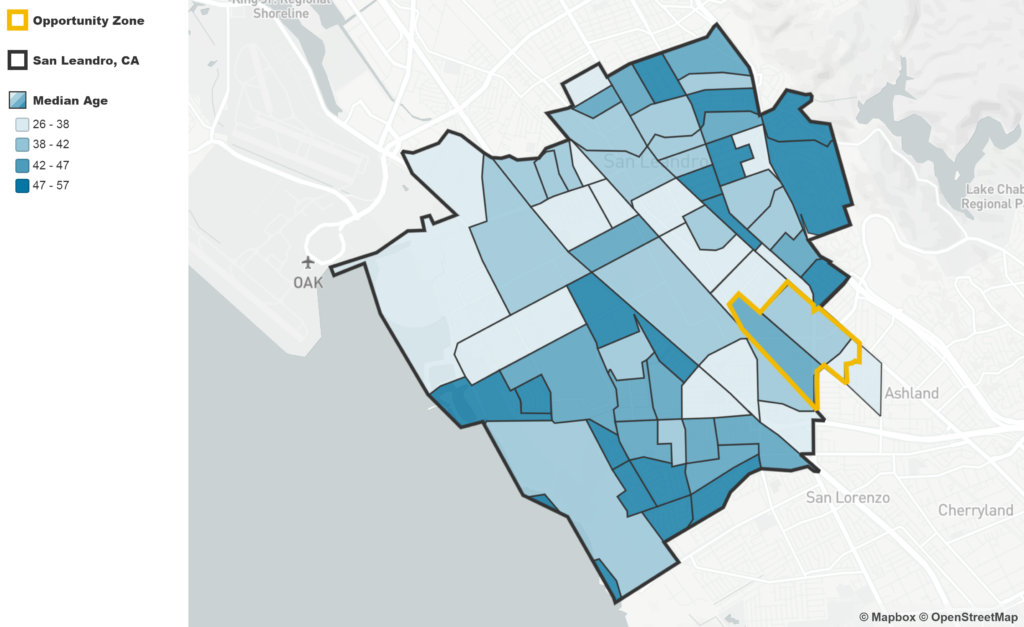

In order to provide investors with the most current demographics and statistics about the City of San Leandro and the Opportunity Zone area, staff contracted with mySidewalk, a city intelligence tool company that helps communities use visualized data to describe and create an Opportunity Zone Dashboard that “tells the story” of the Zone. The dashboard includes data sets on age, ethnicity, household size, workforce, healthy neighborhoods and more, with maps and graphs similar to Figure 1 and 2.

Figure 1. San Leandro Median Age

Figure 2. San Leandro Race/Ethnicity Totals

San Leandro has identified two clusters, the Bay Fair Transit-Oriented Development (TOD) Plan Area and the San Leandro Business Center (100 Halcyon Drive), each with their own unique and valuable markets, culture, assets and opportunities.

What are Opportunity Zones/Funds?

Opportunity Zones are a new tool for community development that provide tax incentives for investment in designated census tracts. Investments made by individuals through special Opportunity Funds in these zones are eligible for the deferment or elimination of federal taxes on capital gains.

A Qualified Opportunity Fund is an investment vehicle that is set up as either a partnership or corporation for investing in eligible property that is located in an Opportunity Zone, and that utilizes the investor’s gains from a prior investment for funding the Opportunity Fund. A Fund must hold at least 90% of its assets in qualifying property.

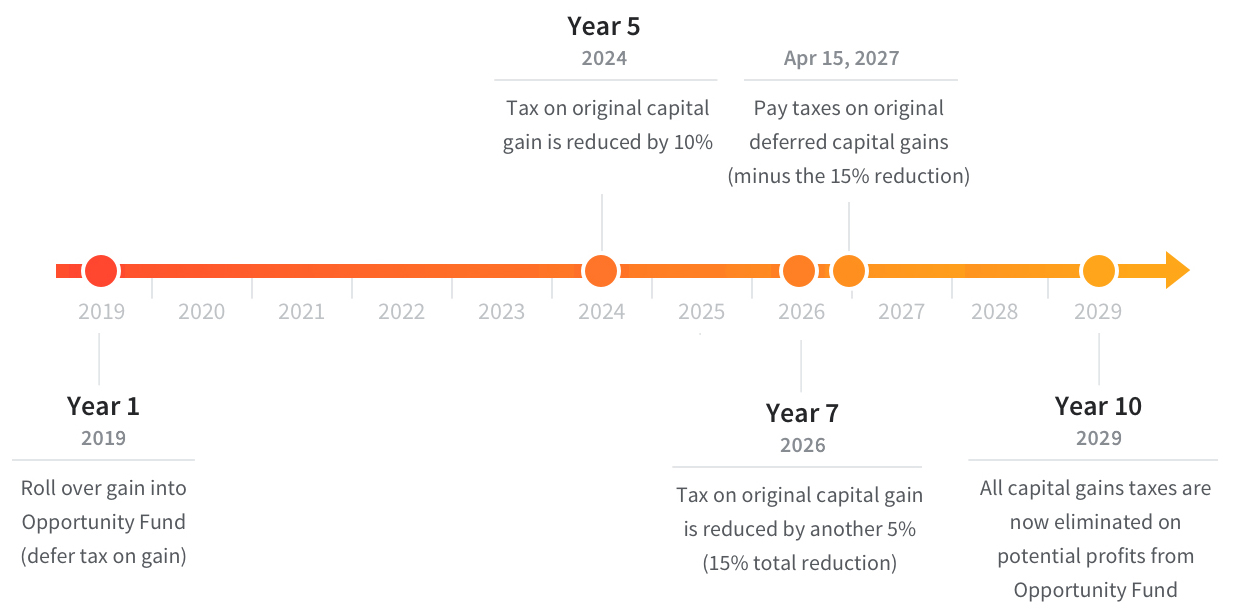

There are three tax advantages to investing in Opportunity Zones.

1. Temporary Deferral (Year 1)

1. Temporary Deferral (Year 1)

A temporary deferral of inclusion in taxable income for capital gains reinvested into an Opportunity Fund. The deferred gain must be recognized on the earlier of the date on which the opportunity zone investment is disposed of or December 31, 2026.

Those who invest realized capital gains into a Qualified Opportunity Fund can defer paying capital gains tax for those earnings until April 2027 for investments held through December 31, 2026. Gains must be invested in a Qualified Opportunity Fund within 180 days in order to qualify for any tax treatment available under the Opportunity Fund program.

2. Step-Up in Basis (Year 5 or 7)

A step-up in basis for capital gains reinvested in an Opportunity Fund. The basis is increased by 10% if the investment in the Opportunity Fund is held by the tax payer for at least 5 years and by an additional 5% if held for at least 7 years, thereby excluding up to 15% of the original gain from taxation.

Those who hold their Opportunity Fund investments for at least five years prior to December 31, 2026, can reduce their liability on the deferred capital gain principal invested in the Opportunity Fund by 10%. If the investment is held for a minimum of seven years prior to December 31, 2026, the tax liability can be reduced by 15% total.

3. Permanent Exclusion (Year 10)

A permanent exclusion from taxable income of capital gains from the sale or exchange of an investment in an Opportunity Fund if the investment is held for at least 10 years. This exclusion only applies to gains accrued after an investment in an Opportunity Fund.

Those who hold their Opportunity Fund investment for at least 10 years can expect to pay no capital gains taxes on any appreciation in their Opportunity Fund investment. That’s because Opportunity Fund gains earned from Opportunity Zone investments can qualify for permanent exclusion from the capital gains tax if the investment is held for at least 10 years.

To learn more about San Leandro’s Opportunity Zone click here.

Leave a Reply